As we progress into 2024, there’s a notable surge in outpatient procedures now conducted in ambulatory surgical centers (ASCs), primarily due to expanded approval for various procedures traditionally reserved for hospitals.

For ASCs, the increase in the variety and volume of procedures presents an opportunity for substantial revenue growth. However, it also introduces challenges, especially within their revenue cycle. Unlike hospitals, ASCs often operate with more streamlined administrative processes and may not have the extensive infrastructure necessary to handle the intricacies associated with a broader range of procedures.

Now, each aspect of their operation, from managing labor costs, navigating complex payer landscapes, providing transparent financial information, and facilitating effective claim submission, demands a strategic approach.

1. Rising Labor Costs

ASCs face significant financial challenges due to rising labor costs. This increase in healthcare wages, exemplified by recent legislation such as California’s SB 525, is not just a local phenomenon but part of a broader national trend. While this legislation aims to improve the welfare of healthcare workers, it also imposes a financial burden on healthcare facilities, including ASCs.

As operational costs escalate, these centers must develop efficient strategies to maintain financial sustainability without compromising the quality of care. The development of these strategies is particularly crucial because the growth of ASCs largely depends on their ability to manage these rising costs effectively.

Many healthcare organizations are turning to AI and automation technologies to address these challenges and:

- Automate routine and time-consuming tasks within the revenue cycle, such as data entry, claims processing, and eligibility verification, to alleviate the workload on human staff and allow them to focus on more complex and strategic activities.

- Enable efficient resource allocation by analyzing historical data and current workflows to optimize staffing levels, help organizations make informed decisions about human resource allocation, and avoid overstaffing and overpaying for labor.

- Enhance the speed and accuracy of claim processing and predict and prevent claim denials, reducing the need for extensive manual intervention.

2. Evolving Payer Landscape

The evolving payer landscape presents both challenges and opportunities for ASCs.

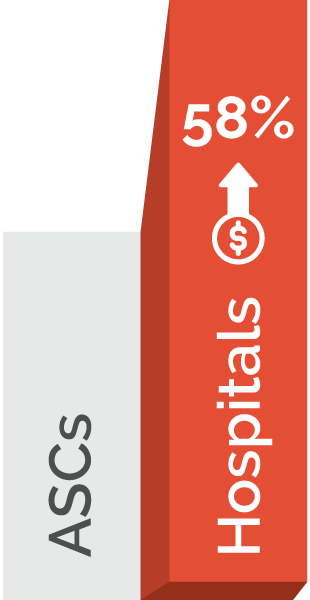

With the shift towards value-based care and increased scrutiny on healthcare spending, ASCs are navigating a complex environment of reimbursement models and payer contracts. Insurers and government payers increasingly focus on cost-effective care, which often favors using ASCs for specific procedures over traditional hospital settings due to their lower overhead costs.

For example, hospitals charge up to 58% more than ASCs for the same procedures, making them an attractive option for both patients and payers.

However, this shift also means ASCs must adhere to stringent quality metrics and reporting requirements to secure favorable reimbursement rates. Additionally, the increase in high-deductible health plans places more financial responsibility on patients, resulting in more cost-conscious patients seeking care that balances quality and affordability.

In response to these changes, ASCs are adapting by expanding their service offerings to align with payer and patient expectations and investing in technologies that improve patient outcomes and satisfaction, such as advanced surgical techniques and enhanced recovery protocols, which can lead to better reimbursement scenarios.

Relating to the revenue cycle, ASCs could benefit from:

- Developing strategies to negotiate payer contracts effectively and manage the increased administrative burden associated with these contracts.

- Focusing on improving the accuracy of coding and billing processes to minimize claim denials and delays in reimbursement.

- Implementing advanced data analytics and technology solutions to track and analyze payer trends and patient demographics to enable more strategic decision-making in patient care and operational management and to negotiate more favorable contracts based on the data presented.

3. Demand for Price Transparency

In an era where healthcare consumers are more informed and cost-conscious, patients are actively seeking clear and upfront pricing information before undergoing procedures. As previously mentioned, this trend is driven by the rise in high-deductible health plans, prompting them to shop around for the best value in healthcare services.

Another factor to consider is that the demand for price transparency isn’t just coming from patients but also from regulatory bodies via the No Surprises Act.

ASCs, known for their cost-effectiveness compared to traditional hospital settings, are uniquely positioned in this landscape. However, the pressure for transparency from both patients and regulators requires ASCs to adopt more transparent pricing models and communicate effectively with patients about the cost of care.

This shift challenges ASCs to balance operational efficiency and profitability while providing detailed cost information to patients, which includes not just the cost of the surgery but also associated expenses like anesthesia, facility fees, and any potential follow-up care.

In response to this demand, many ASCs are:

- Implementing advanced software and tools to provide patients with accurate and comprehensive price estimates.

- Focusing on improving patient engagement and education, ensuring patients are well-informed about the financial aspects of their care.

- Utilizing technology to streamline and optimize the billing and payment process, such as offering online payment systems and automated billing solutions.

4. Difficulty with Patient Collections

Adopting high-deductible health plans means a larger portion of the revenue for ASCs comes directly from patients rather than traditional insurance payers—making patient collections an even more critical component of their revenue cycles.

Patients are often required to pay significant out-of-pocket costs for procedures performed in ASCs, which can lead to difficulties in collections and cash flow issues for these centers. Timely and efficient collection of patient payments is essential to maintain a healthy financial status, but it can be challenging due to patients’ varying financial situations and the complexity of healthcare billing.

To address these challenges, ASCs are:

- Increasingly adopting advanced billing and payment technologies such as online payment portals to offer automated payment plans and provide clear, itemized billing statements to facilitate easier patient payments and access payment means such as specific credit agencies.

- Offering upfront communication about estimated costs and financial counseling to help patients prepare for their financial obligations and reduce the incidence of unpaid bills.

- Ensuring accuracy in billing and coding to align initial cost estimates with final bills.

5. Avoiding and Managing Denied Claims

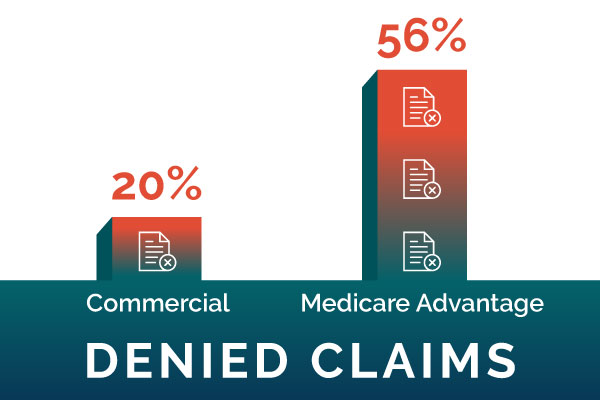

Rising claim denials are impacting healthcare as a whole, and ASCs are no expectation.

Claim denials can occur for various reasons—such as coding errors, lack of prior authorization, or discrepancies in the claim submission process—and delay the reimbursement process, requiring additional resources for reprocessing and appealing claims.

For ASCs, which typically operate with leaner margins than larger hospitals, frequent claim denials can lead to substantial revenue losses and cash flow disruptions. Moreover, the time and effort expended in managing these denials divert resources away from patient care and operational efficiency.

The increase in claim denials is partly attributed to the ever-changing payer rules and regulations, which can be challenging to keep track of and comply with, especially for smaller ASCs without dedicated revenue cycle management teams.

To mitigate denials and protect their bottom line, ASCs should focus on:

- Implementing proactive measures to prevent denials, such as improving coding accuracy, ensuring compliance with payer policies, and verifying patient eligibility and authorization in advance.

- Utilizing advanced analytics and revenue cycle management software to identify patterns in denials to address systemic issues and reduce the likelihood of future denials.

- Regularly training staff on the latest billing practices and updates in healthcare regulations to ensure that claims are submitted correctly and efficiently.

Maximizing ASC Revenue Potential with RCM Solutions

In the face of these diverse and complex challenges, the benefits of enlisting the help of an external, end-to-end revenue cycle management expert become increasingly apparent.

At SYNERGEN Health, we offer a holistic approach to ASC revenue cycle management, addressing everything from process optimization through automation to AI-driven denial management.

Wondering how your ASC’s revenue cycle could benefit from sophisticated RCM technology? We’ll provide you with a free customized roadmap to optimization and financial success.